Today, I will be talking about Kuda and OPay. The best among them, Which is better, Advantage over the other and similarities between them.

Both are financial institution that aim to provide seamless financial support to individual. Kuda is mobile only bank while OPay is a fintech company that provide POS machine services to support individual financial needs.

Kuda vs OPay, Companies Profiles and Reviews

Advantages of Kuda bank and OPay Fintech Company

Advantages of Kuda Bank

- Kuda bank issue free atm card to it’s users

- Kuda user can create smart budget that can help them control their spending

- See where your money goes without solving equations.

- 15 percent interest for annual saving.

- Zero percent transactions fees for sending money

- Mobile topup (buying of airtime and data subscription)

- Payment links

- Kuda offer 25 free transfer to other Banks and N10 transactions charges for additional transfer

- No physical location needed

- All you need is kuda app, plus internet connection and your debit card or credit card.

- Must of all, Kuda is a bank that operate online.

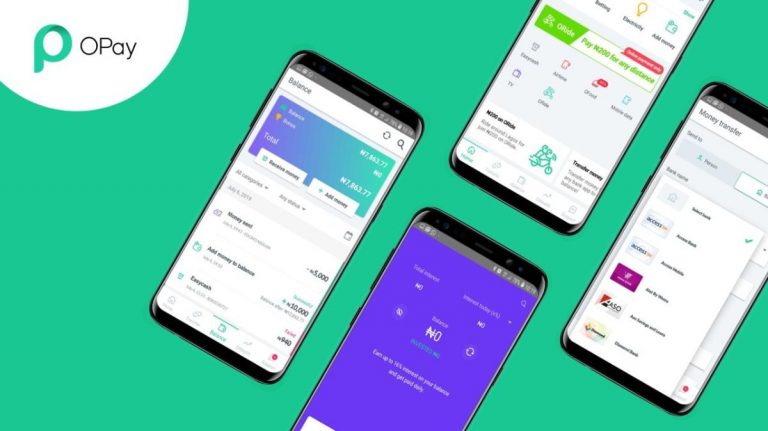

Advantages of OPay

- You can become a POS agent using OPay

- Send and transfer money on OPay mobile app

- No charges on wallet top up

- Unlimited airtime discount

- No charges on utility bills (such as Electricity bills and TV subscription)

- N10 charges to any bank in Nigeria

- 0.7 transactions charges on POS.

- Offer free POS when agent meet requirements and paid one for who cannot wait for eligibility.

Similarities between Kuda and OPay.

- Both fintech company operations are based online.

- Both companies can be accessed via mobile app and on web

- Both deal with sending and receiving money

- Both companies are well known

- Both financial institution charge N10 transactions fees.

- Kuda and OPay offer free debit card and credit card that can be manage via their user dashboard.

- User needs to connect their account to the bank to fund their wallet.